are campaign contributions tax deductible in 2020

Are Political Contributions Tax. While there is no tax.

What Is Blocking The Sustainable Energy Transition In The Us Insights From The Citizens United Ruling Blog Post Pri

An anonymous contribution of cash is limited to 50.

. If you claim the standard deduction you cant deduct charitable contributions. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible This answer might take a lot of people by surprise. However for tax year 2021 the taxes you file in 2022 you can deduct charitable contributions up to 300 without itemizing deductions.

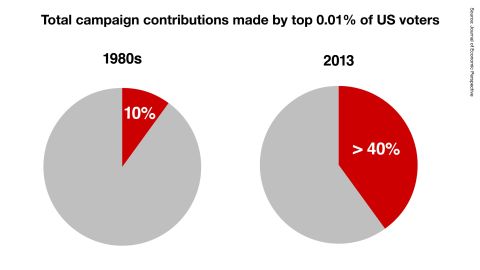

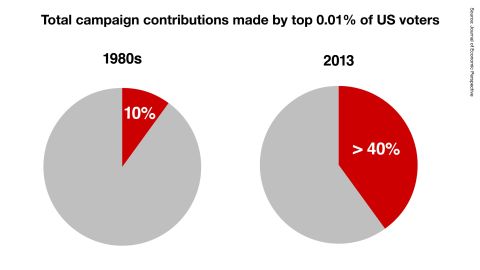

If you have made contributions donations or payments for any of these that amount cant be deducted from your taxes. Generally only a small minority of total contributions come from those who give 200 or less. Any amount in excess of 50 must be promptly disposed of and may be used for any.

No political contributions are not tax-deductible. 100 limit on cash contributions A campaign may not accept more than 100 in cash from a particular source with respect to any campaign for nomination for election or election to federal office. With the 2020 elections behind us and tax-filing season now here you might be wondering whether or not you can deduct political contributions you made last year.

The 2019-2020 contribution limit was capped at 2800. Raising Money for Campaigns and Organizations. The Combined Federal Campaign CFC is one of the largest and most successful workplace fundraising campaigns in the world.

Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible This answer might take a lot of people by surprise. Want to improve your tax management as an investor. 435 1 votes With the 2020 elections behind us and tax-filing season now here you might be wondering whether or not you can deduct political contributions you made last year.

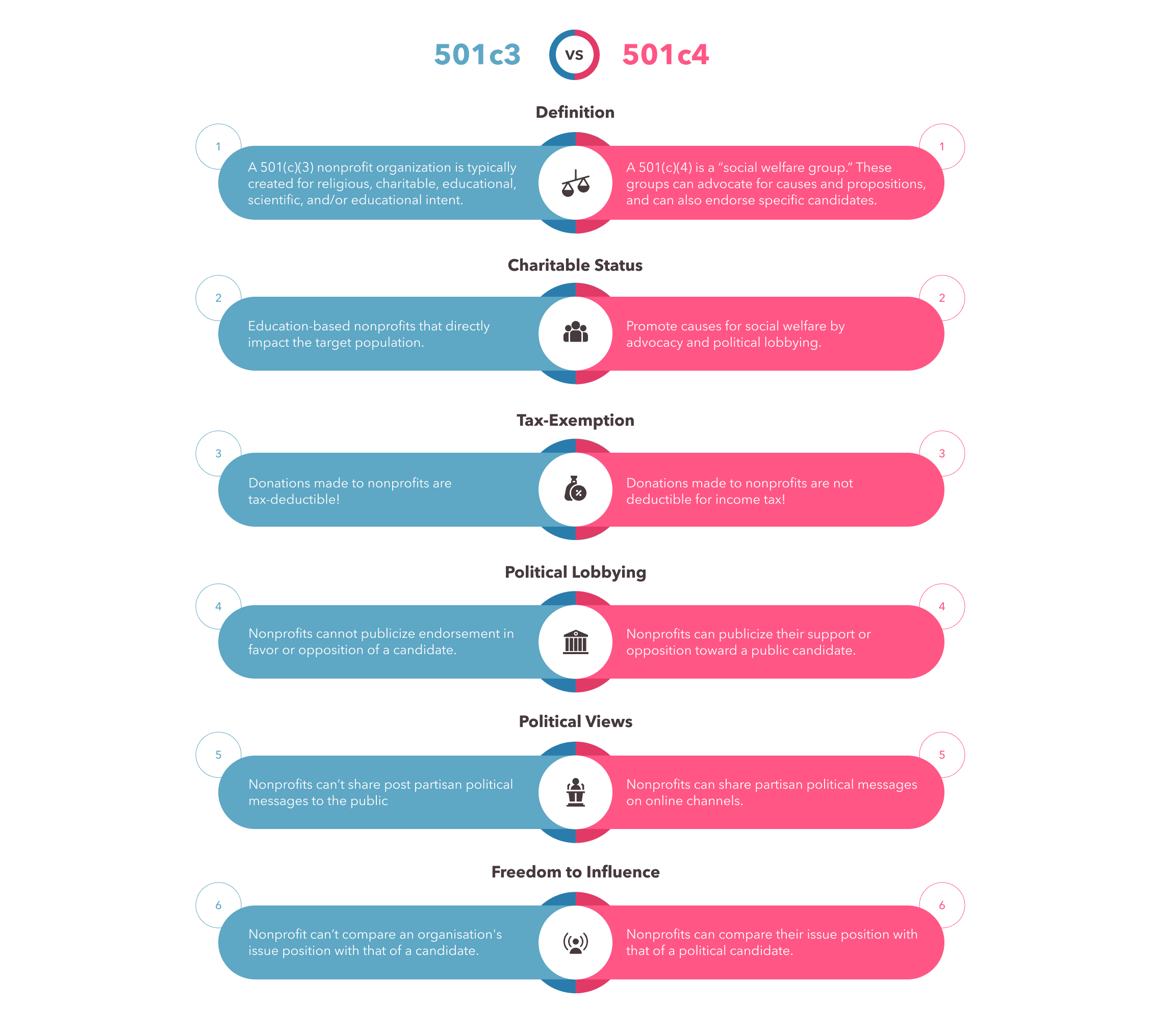

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Likewise gifts and contributions to 501 c 4 social welfare organizations are not deductible as charitable contributions. The answer is no political contributions are not tax deductible.

You can request a Political Contribution Refund if you contribute money to. 50 limit on anonymous contributions. No political contributions are not tax-deductible.

For the purposes of this deduction qualifying organizations are those that are religious charitable educational scientific or literary in purpose. Political donations are not tax deductible on federal returns. The bottom line is if you dont itemize and take the standard deduction you cant deduct charitable donations.

Usually you can only deduct charitable contributions if you itemize deductions by filing Schedule A along with Form 1040. Opens in new window For Donors and Supporters. Count me among those smaller donors who has given a bit here and there to campaigns.

Political donations to federal candidates and committees are not deductible from federal income taxes whether they are made online or in person. You may qualify for a refund for your political contributions made to Minnesota political parties and candidates for state offices. The 2019-2020 contribution limit was capped at 2800.

The law changed in this area due to the Coronavirus Aid Relief. However taxpayers who dont itemize deductions may take a charitable deduction of up to 300 for cash contributions made in 2020 to qualifying organizations. Opens in new window Contact Us.

The following list offers some examples of what the IRS says is not tax-deductible. Minnesota Legislature state House or Senate Minnesota governor lieutenant governor attorney general. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund.

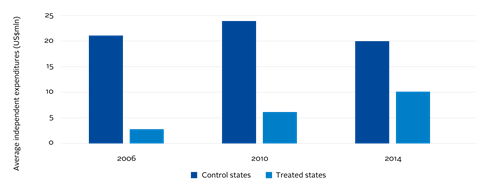

When people do give most political donations are large given by a few relatively wealthy people. However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible.

Campaign Funding Explained How Are Political Campaigns Financed Caltech Science Exchange

As Its Revenue Dropped The Nra Took Millions Of Dollars From Its Charities And Funded Political Groups Opensecrets

Political Financing Handbook For Registered Parties And Chief Agents Ec 20231 June 2021 Elections Canada

Here Are The Billionaires Who Donated To Joe Biden S 2020 Presidential Campaign

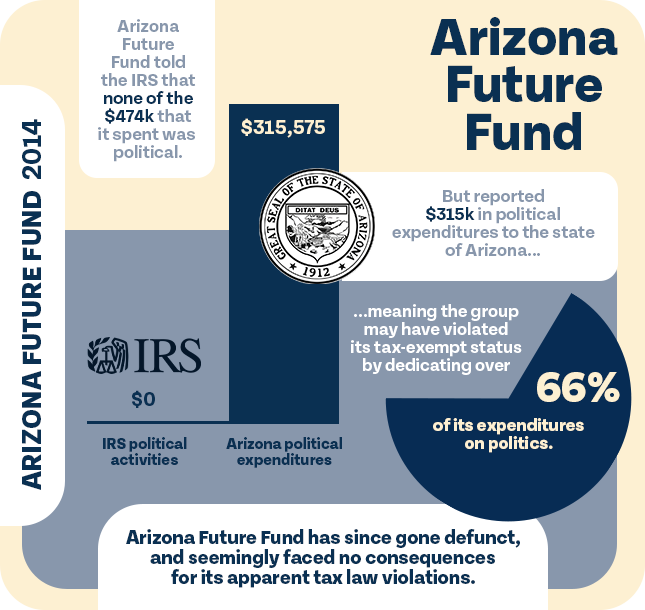

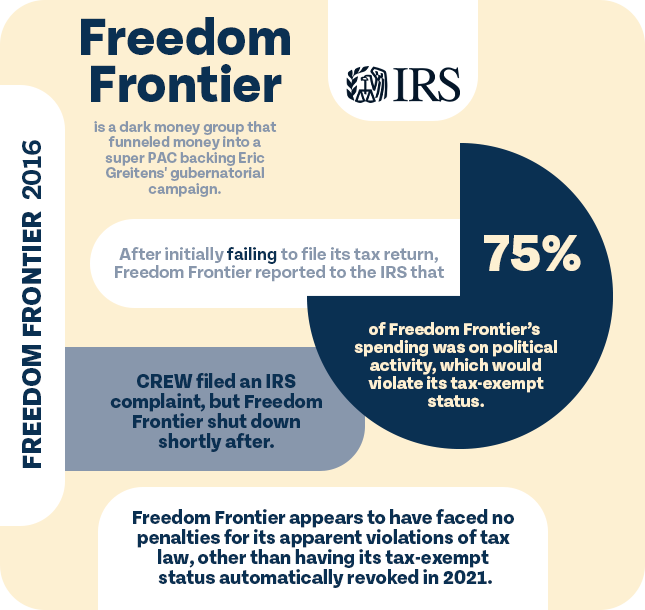

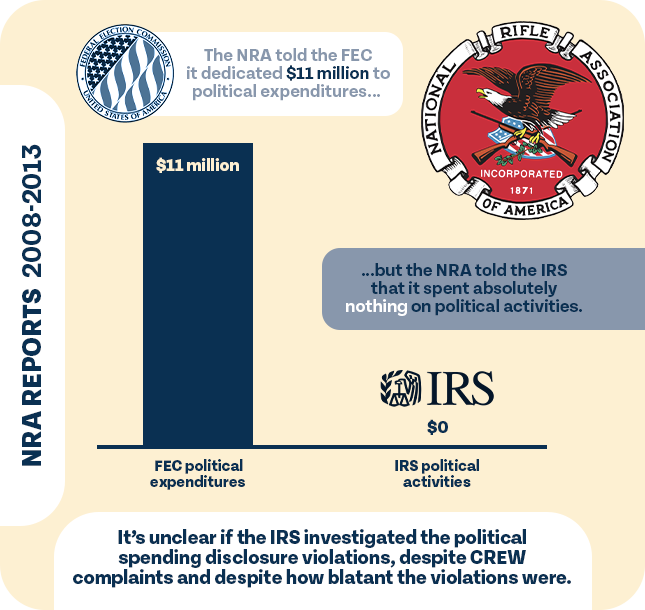

The Irs Is Not Enforcing The Law On Political Nonprofit Disclosure Violations Crew Citizens For Responsibility And Ethics In Washington

Congressional Fundraisers Lobby Companies That Suspended Donations After Capitol Riot

Here Are The Billionaires Backing Donald Trump S Campaign As Of February 2020

2020 Contribution Limits Increase For Utah Income Tax Credit Or Deduction

These Billionaire Donors Spent The Most Money On The 2020 Election

The Irs Is Not Enforcing The Law On Political Nonprofit Disclosure Violations Crew Citizens For Responsibility And Ethics In Washington

Private Equity Hedge Funds Accounted For Over 625 Million In Political Spending During 2020 Campaign Study Says

The Irs Is Not Enforcing The Law On Political Nonprofit Disclosure Violations Crew Citizens For Responsibility And Ethics In Washington

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Money S Power In Politics Give Everyone A Share Cnn

The Irs Is Not Enforcing The Law On Political Nonprofit Disclosure Violations Crew Citizens For Responsibility And Ethics In Washington

Campaign Funding Explained How Are Political Campaigns Financed Caltech Science Exchange

Gofundme Donations May Have Tax Consequences Marks Paneth

Understand The Third Party Fees On Donations Through Give Lively

Irs Releases Form 1040 For 2020 Spoiler Alert Still Not A Postcard